The figure for gross profit is achieved by deducting the cost of sale from net sales during the year. 30000 10000 5000 35000.

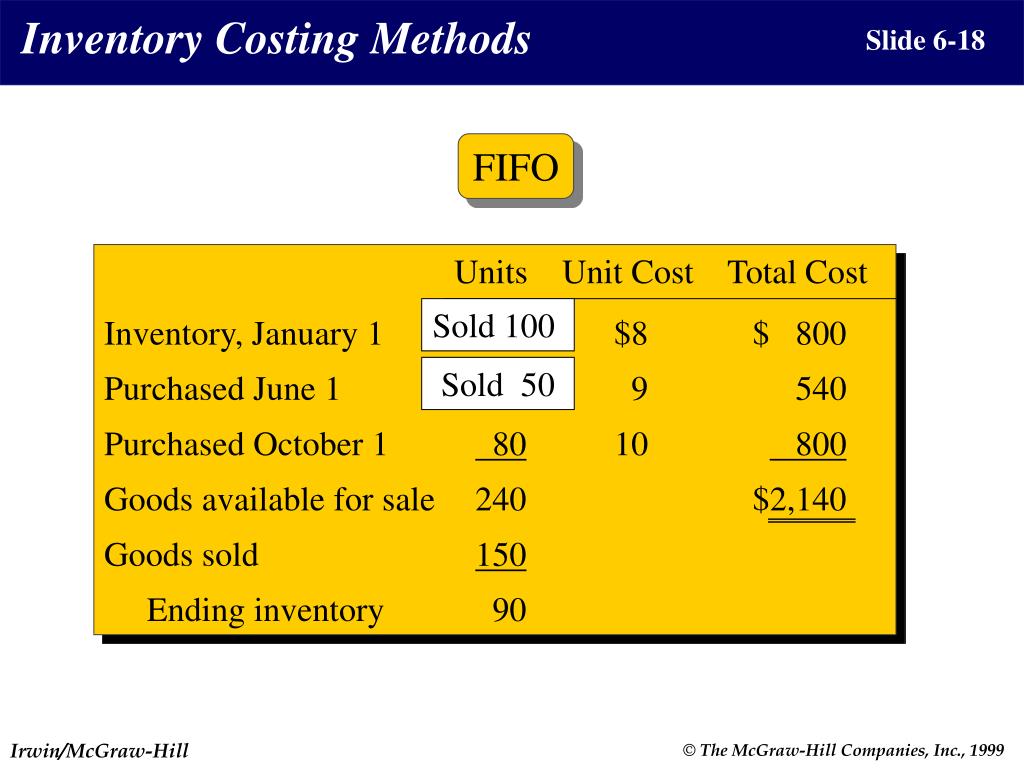

Ppt Cost Of Sales And Inventories Powerpoint Presentation Free Download Id 5987385

Multiple Choice Beginning Merchandise Inventory plus Net Delivered Cost of Purchases less Ending Merchandise Inventory equals Cost of Goods Sold.

. Gross Profit Costs of Goods Sold Sales Revenue. Plus net purchases plus ending inventory. An alternative way to calculate the cost of goods sold is to use the periodic inventory system which uses the following formula.

What is reported on the income statement. Cost of goods sold equals beginning inventory plus _____ minus ending inventory. Neither A or B.

Both A and B. Cost of merchandise sold equals beginning. To determine the cost of goods sold in any accounting period management needs.

The cost of goods available for sale equals the beginning value of inventory plus the cost of goods purchased. The cost of goods sold equals the cost of goods available for sale less the ending value of inventory. Since the bookstore sold only one book the cost of goods sold is 88 1 x 88.

Minus net purchases minus ending inventory. On May 15 10 items are purchased at 14 each. Thus the calculation is.

Merchandise inventory also called Inventory is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease. On May 1 beginning inventory consists of 10 items at a cost of 10 each. There are several impacts of inventory on the cost of goods sold including Purchase and production cost of inventory plays an important role in recognizing gross profit for the period.

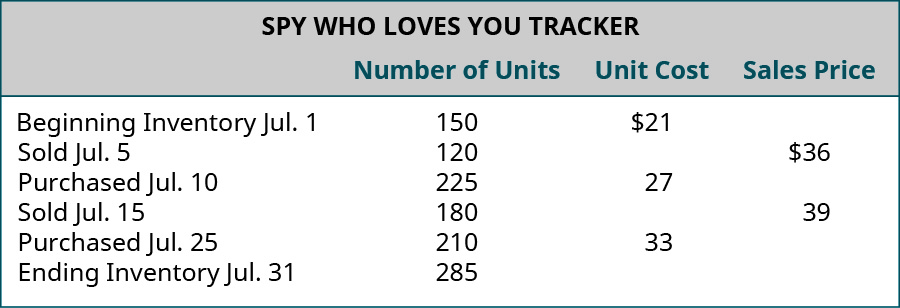

June 1 150 units 2600 June 10 200 units 3900 June 15 200 units 4200 June 28 150 units 3300 14000 A physical count of merchandise inventory on June 30 reveals that there are 100. Inventory was 29783 at the beginning of the year and 34038 at the end of the year. The total of the cost of goods sold plus the cost of the inventory should equal the.

Cost of merchandise sold. To calculate direct materials add beginning direct materials to direct materials purchases and subtract ending direct materials. Your business has 10000 in inventory at the start of the year.

The calculation of the cost of merchandise sold is to add the beginning inventory balance to merchandise purchases during the period and subtract out the ending inventory balance. The cost of goods sold is calculated as follows. Using perpetual FIFO the cost of goods sold for the month ended May 31 equals.

Ending inventory plus net purchases minus beginning inventory. Calculate the cost of inventory with the formula. Beginning inventory plus the cost of goods purchased equals a cost of goods sold from ACCT 2010 at The Hong Kong University of Science and Technology.

B 134 a 125 b 134 c 147 d 22 Definition. Beginning inventory Purchases - Ending inventory Cost of goods sold. Heres what this formula looks like in practice.

Thus if a company has beginning inventory of 1000000 purchases during the period of 1800000 and ending inventory of 500000 its cost. Plus net purchases minus ending inventory. Lets also assume that the retailer begins the year with 100 units of the product.

You buy 9000 in new products during the year. The credit entry to balance the adjustment is 13005 which is the total amount that was recorded as purchases for the period. The Cost of goods sold equals A.

Beginning merchandise inventory Merchandise purchases - Ending merchandise inventory. Credit Sale Revenue debit COGS credit inventory debit. The cost of goods sold is 10000 9000 - 6000 13000.

Example of Inventory Cost and Cost of Goods Sold. The ending inventory of four unsold books is reported at the cost of 352 4 x 88. Your company sells 469300 of goods during the year at a cost of goods sold of 398600.

An increase in closing inventory decreases the amount of. Total Merchandise Available for Sale less Ending Merchandise Inventory. The inventory turnover ratio is closest to.

Advanced Math questions and answers. Your company still has 6000 in inventory at the end of the year. Minus net purchases plus ending inventory.

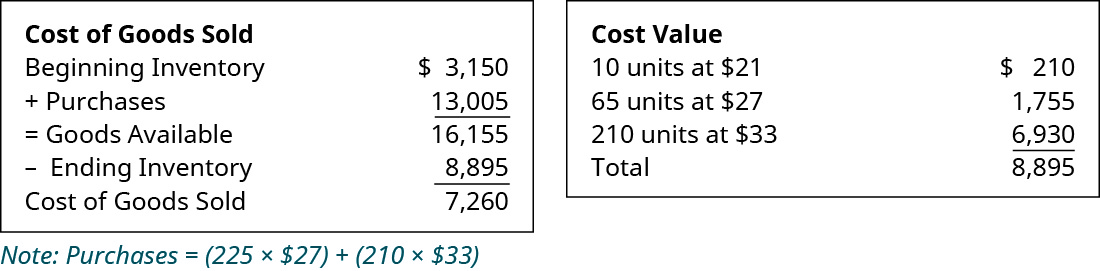

The value of COGS can be used on. The inventory at the end of the period should be 8895 requiring an entry to increase merchandise inventory by 5745. The cost of goods sold will likely be the largest expense reported on the income statement.

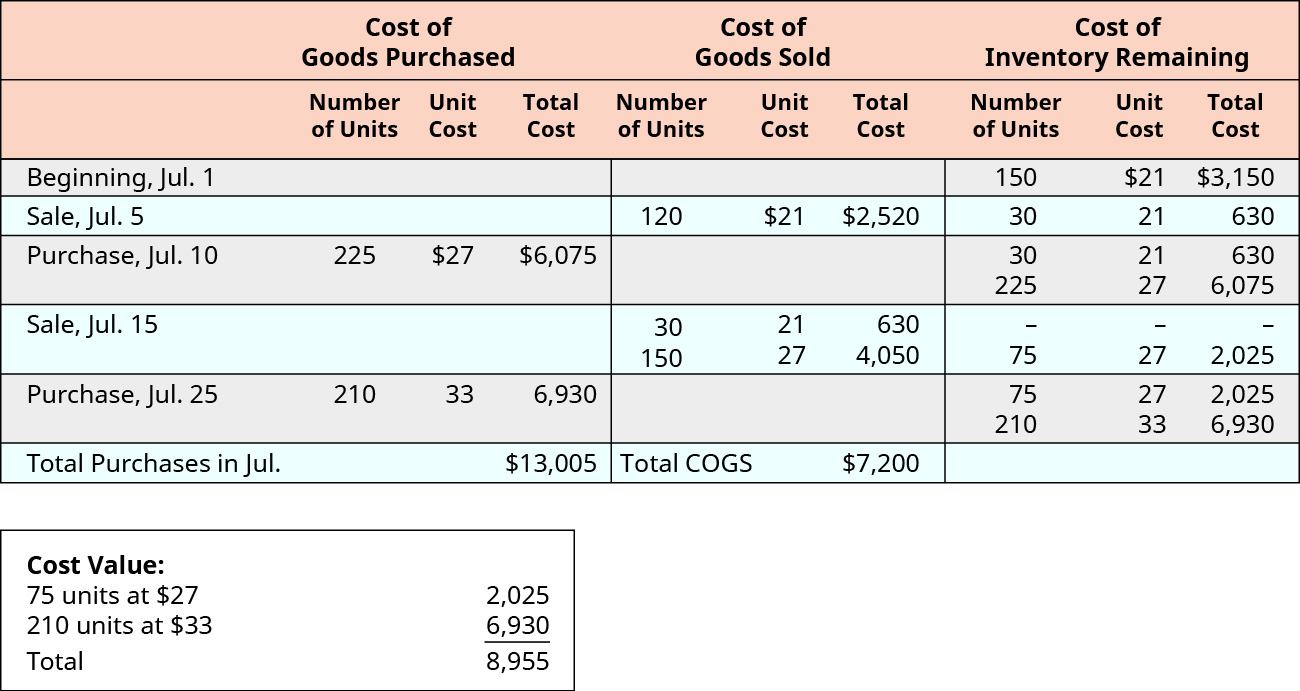

Ending inventory plus net purchases minus beginning inventory. Cost of goods sold was calculated to be 7260 which should be recorded as an expense. Merchandise inventory is the cost of goods on hand and available for sale at any given time.

The Cost of Inventory Beginning Inventory Inventory Purchases Ending Inventory. To show the connection between inventory and the cost of goods sold lets assume that a retailer sells only one product. Previous Net Purchases and Goods Purchased.

TP1209 TP1209 03112017 Business College answered The Cost of goods sold equals A. Use the information above to answer the following question. On May 3 10 items are purchased at 12 each.

On May 8 12 items are sold. Beginning i Get the answers you need now. Then entry to record the sale of merchandise to a customer on account would include a _____.

Cost of merchandise sold equals beginning inventory A.

Ashworth A02 Lesson 4 5 Exam Attempt 1 Answers Lesson Exam Inventory Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

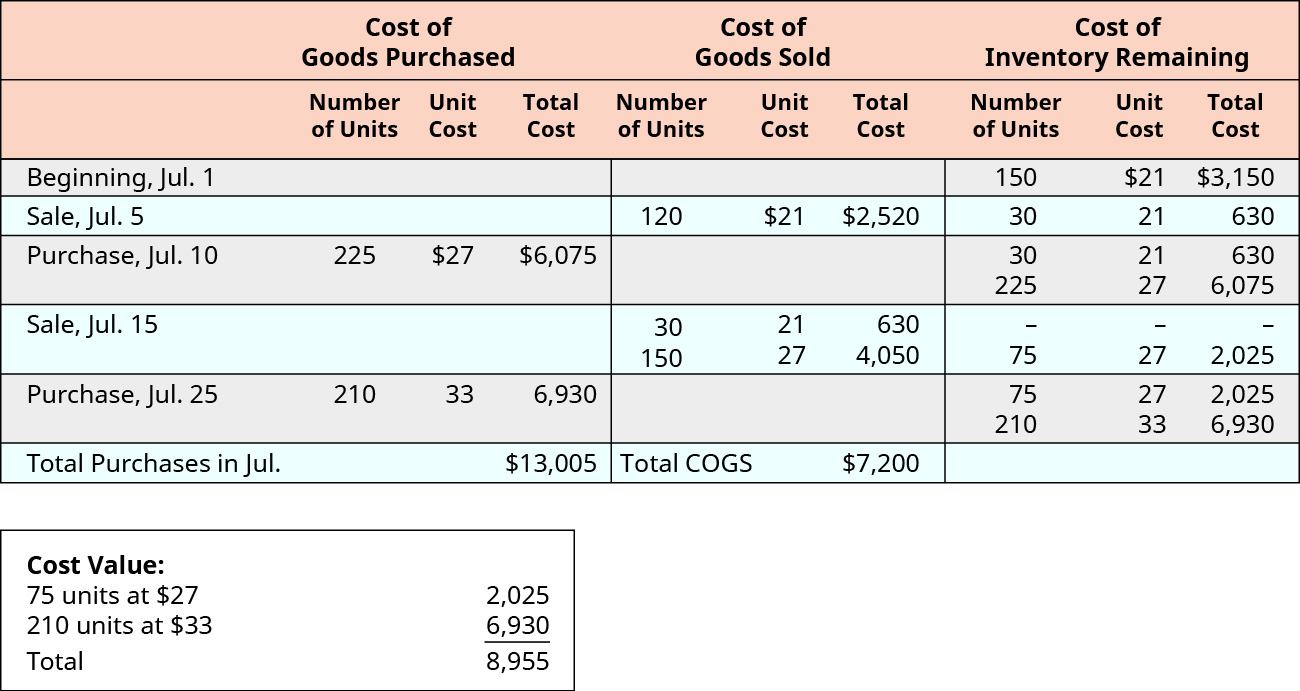

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

0 Comments